Is amazon flex 1099

Amazon Flex 1099 forms are typically available by the end of January for the previous tax year. As an independent contractor for Amazon Flex, you are responsible for paying taxes on your earnings. In conclusion, it is important to keep track of your earnings as an Amazon Flex driver and to file your taxes on time. By accessing and downloading ...

Amazon Flex driver Bernard Waithaka is in the midst of a different but related argument. He and other Massachusetts delivery drivers allege they've been improperly classified as contractors when ...

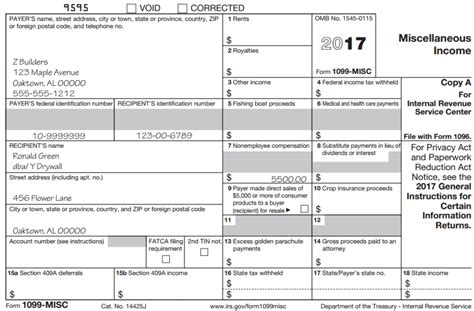

How do you get your Amazon Flex 1099 tax form? You can find your Form 1099-NEC in Amazon Tax Central. Internal Revenue Service regulations your Amazon Flex 1099 form download to be available by January 31st. NEC stands for nonemployee compensation.To access a digital copy of your form, please follow these steps: Log in to Amazon Associates ; Hover over your email address displayed in the top right corner, and select Account Settings.STADION FLEX FUND CLASS 1- Performance charts including intraday, historical charts and prices and keydata. Indices Commodities Currencies StocksYou can ask Amazon for your 1099. If you participate in Amazon Flex, or have participated in a similar program, you can request a copy of your 1099 from Amazon. You can request a 1099 form from Amazon Tax Reporting by logging into your account and selecting “View your 1099.”. You can also call Amazon’s Tax Reporting team.As an independent contractor or freelancer for Amazon Flex, getting your 1099 form is crucial for filing your taxes accurately. Without this form, you may not be able to report your income correctly, which can result in penalties and fees. Additionally, having your 1099 form on hand makes it easier to keep track of your earnings and expenses ...Amazon has to report at $600. You have to pay SE tax at $400 of net profit. You have to report for income tax purposes if total income > $12,550, even if this is say $12,500 in W-2 income and $100 in Flex income.

The Amazon Flex app also provides safety videos, articles, and information on pet safety support on how to stay safe when a dog and pet is present. Optimized maps: Amazon Flex maps helps you navigate and shows known speed limits, road closure alerts, and live traffic conditions, so you can choose which route to take.Amazon has to report at $600. You have to pay SE tax at $400 of net profit. You have to report for income tax purposes if total income > $12,550, even if this is say $12,500 in W-2 income and $100 in Flex income.About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy & Safety How YouTube works Test new features NFL Sunday Ticket Press Copyright ...Amazon Flex typically begins to send out 1099 forms for the previous year towards the end of January (legally they must mail them out by 1/31), so keep an eye out for them in the mail! Confused by all of the terms and instructions? Not sure how to fill out Schedule C forms? Keep reading for a tutorial on the entire process! OverviewThis is the "non-employee compensation" 1099 shape you receive by Amazon Flex if you earn for least $600 with them (if it is under $600, you will not receive …Most Amazon Flex delivery partners earn $18-$25 per hour.* If you join us, you can build your own schedule, seven days a week. You can schedule work ahead or accept same-day offers when you have spare time. _____ You must be 21 or over and have a valid ID to be an Amazon Flex delivery partner.

Box I & J: Filing 1099’s If you paid a contractor more than $600 you are required to send them a 1099-NEC. These boxes ask you to report whether or not that applies to you. Note that if you mark “yes” to the first box, and “no” to the second, it’s likely the IRS will follow up, and you could get penalized for every unsent 1099.Amazon Flex Rewards is a program exclusively for Amazon Flex delivery partners to thank you for all the work you do. With Amazon Flex Rewards, you can earn cash back with the Amazon Flex Debit Card, enjoy Preferred Scheduling, and access thousands of discounts as well as tools to navigate things like insurance and taxes.Sign in to Amazon.com using the email address and password that is currently associated with your Amazon Flex account. 2. Click or tap Your Account > Login & security.DoninGA. Level 15. No you do not need to be an LLC. You can report your self-employment income and expenses on a Schedule C using your own Social Security number. Schedule C is included with and part of your personal tax return, Form 1040. December 12, 2019 11:57 AM. 0.About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy & Safety How YouTube works Test new features NFL Sunday Ticket Press Copyright ...Have you ever wondered how the unbelievably rich and successful founder of Amazon came to be the person he is today? The story behind Jeff Bezos and the making of Amazon is certainly an interesting one.

Us number generator.

A little tax insight for those who aren’t aware. Current mileage rate sponsored by our friends in the government or current deductible amount per mile driven for flex = $0.585/mi. 48,0000miles x 0.585/mi = $28,000 YOU DO NOT OWE TO THE GOVERNMENT IN TAXES. $40,000 (totals flex income) - $28,000 in deductible income = $12,000 is the …Amazon Flex is a flexible side hustle that pays you to deliver packages in your free time. ... Amazon will send you a 1099 tax form stating your taxable income for the year. Current IRS rules require you to pay taxes on any self-employment income above $400. A friendly suggestion is to set aside 30% of your earnings for taxes.Printing your Social Security Administration (SSA) 1099 online is a quick and easy process. This article will provide you with step-by-step instructions on how to print your SSA 1099 online.Amazon Flex offers both a W2 and a 1099 form to its drivers. Drivers who choose to work for Amazon Flex are classified as independent contractors and will receive a 1099 form at the end of the year for income taxes. However, drivers who are employed by Amazon Flex through a third-party company, such as Caviar or Doordash, will receive a W2 form ...

Most Amazon Flex delivery partners earn $18-$25 per hour.* If you join us, you can build your own schedule, seven days a week. You can schedule work ahead or accept same-day offers when you have spare time. _____ You must be 21 or over and have a valid ID to be an Amazon Flex delivery partner.The easiest way to get your Amazon Flex 1099 is to download it from your Amazon Flex account online. The Amazon Flex 1099 includes your earnings for the year, any bonuses or incentives you received, and any taxes that were withheld. Amazon Flex typically sends out 1099s by January 31st of each year.DoninGA. Level 15. No you do not need to be an LLC. You can report your self-employment income and expenses on a Schedule C using your own Social Security number. Schedule C is included with and part of your personal tax return, Form 1040. December 12, 2019 11:57 AM. 0.you need? We're here to help you. Frequently asked questions about Amazon Flex. Getting Started What is required to deliver with Amazon Flex? To sign up for Amazon Flex in the US, you need a valid driver's license, a mid-size or larger vehicle, an iPhone or Android smartphone, and you must be 21 years or older and be eligible to work in the US.Amazon Flex Rewards is a program exclusively for Amazon Flex delivery partners to thank you for all the work you do. With Amazon Flex Rewards, you can earn cash back with the Amazon Flex Debit Card, enjoy Preferred Scheduling, and access thousands of discounts as well as tools to navigate things like insurance and taxes.Amazon has put out the 1099’s for 2019, at least for me it is. Advertisement Coins. 0 coins. ... cuz asked about Flex only, I think around 65k-70k. ReplyAmazon Flex driver Bernard Waithaka is in the midst of a different but related argument. He and other Massachusetts delivery drivers allege they've been improperly classified as contractors when ...Step #1: Stay calm. Don’t worry too much about not receiving a 1099-NEC or 1099-K. It can be annoying not to get a form when you're supposed to, especially if you did everything right — keeping your address up to date and opening a separate PayPal account for your business.522 W Riverside Ave Ste N Spokane, WA, 99201. [email protected] (509) 596-1046 ext 102If you are a U.S. payee and earn income reportable on Form 1099-MISC (e.g. royalty or rent income) by participating in one or more Amazon programs, you may be eligible to …

Apr 20, 2023 · If you are an Amazon Flex 1099 driver, payments close attention to this strain guide. You'll debt self-employment, quarterly and income taxes for the year. In this guide, we'll go over how file and maximize your tax savings at and end of to year.

23 companies to work with as a delivery driver. 1. Amazon Flex. Let’s start with Amazon Flex where delivery drivers work in delivery blocks. The length of those varies by delivery. You would deliver packages ordered on Amazon.com for around 3-6 hours.So I’m moving to a new city for school and the apt I applied to needs my YTD 1099 to verify income. Well, it’s missing in my Tax Central forms (my partner also does Flex and his is available). I’ve called and emailed about 10 times and spoken with multiple people but I just keep getting this bs email over and over again.If your gross payment volume for a calendar year exceeds $20,000 and you have more than 200 transactions in that same year across all your Amazon Payments, Amazon Webstore and Selling on Amazon Accounts, you will get a copy of a Form 1099-K from Amazon Payments early in the following year.NEW: 1099 NEC Tax Form; How do I access my form on line? To access a digital copy of your form, please follow these steps: Log in to Amazon Associates ; Hover over your email address displayed in the top right corner, and select Account Settings. Scroll down to Payment and Tax Information.Amazon Flex offers both a W2 and a 1099 form to its drivers. Drivers who choose to work for Amazon Flex are classified as independent contractors and will receive a 1099 form at the end of the year for income taxes.Jul 24, 2023 · In November 2021, the FTC sent payments to more than 140,000 Amazon Flex drivers totaling nearly $60 million. Now, the FTC is resending checks to people who did not cash their first check. If you get a check, please cash it within 90 days. If your payment is $600 or more, you will receive a 1099 tax form with your check. You can get an Amazon Flex pay stub in one of three ways: Use the Amazon Flex app: If you’re using the app to drive for Amazon Flex, you can see all your earnings, including your pay stub, on the app. However, you won’t have a pay stub if you only use the app to find out where to pick up assignments. Call Amazon Flex: If you’re picking up ...

Lab corps drug screening locations.

Probably because i am cg5.

Is Amazon Flex a W2 or 1099? The drivers will receive a 1099 in January, which will show the number earned as an independent contractor, and that the company is paid to provide Amazon Flex to the driver. Also, depending on your State’s laws, you will need to pay an annual income tax on the gross amount you earn through Amazon Flex.Is Amazon flex independent contractor? Your 2018 IRS Form 1099-MISC is now available. To download your form electronically, follow these steps: Go to https://taxcentral.amazon.com.IMPORTANT TAX RETURN DOCUMENT NOW AVAILABLE Log in with your Amazon Flex email and password. In the "Year-end tax forms" section, click "Find Forms" Click "Download".Want to deliver for Amazon Flex? Get all your questions answered from how to start earning with Flex, how to earn more through our rewards program and more. Want to deliver for Amazon Flex? Get all your questions answered from how to start earning with Flex, how to earn more through our rewards program and more. Feb 17, 2022 · Here is the link to the IRS webpage that discusses 1099-Misc, Independent Contractors and the Self Employed from which the above quote was obtained. You might find this information helpful. Also included below is a link to the IRS' business activity codes. 1099 Misc, Independent Contractors and Self Employed . IRS Business Activity Codes ... you need? We're here to help you. Frequently asked questions about Amazon Flex. Getting Started What is required to deliver with Amazon Flex? To sign up for Amazon Flex in the US, you need a valid driver's license, a mid-size or larger vehicle, an iPhone or Android smartphone, and you must be 21 years or older and be eligible to work in the US.Jan 13, 2023 · Note: At the end of 2023, a new US tax reporting law will take effect and require Amazon to send out 1099-Ks to sellers who made $600 in sales with no transaction threshold. “For calendar tax years before 2023 (2022 tax year and earlier), Amazon is only required to issue a Form1099-K to you if you had: According to Amazon, flex drivers earn $18-$25/hour. And the average Amazon Flex pay is $21.36/hour, as per Indeed. However, your actual Amazon Flex salary will depend on several factors, such as: Your location. The amount of time you take to complete deliveries. ….

1099 Contractor. The IRS is very strict when it comes to tax reports. That’s why it is essential to know what form you need to get in each tax season. ... Is Amazon Flex lucrative enough to become a full-time occupation? There’s no right way to answer this question, but it all depends on the individual’s needs. For example, if you have ...492000. Driving for Amazon flex can be a good way to earn supplemental income. And knowing your tax write-offs can be a good way to keep that income in your pocket! Beyond just mileage or car expenses, getting a 1099 from Amazon means that you can claim a lot of other expenses as tax write-offs: the phone you use to call residents with a locked ... 1099-NEC EIN Number. Can anyone please comment what the EIN number is on the new 1099-NEC. I have my total wages but can’t access the tax central website. Every time I call the support number they can’t seem to understand I’m trying to access my tax forms and not my old Amazon account and can’t restore access. This thread is archived. As of Oct 16, 2023, the average hourly pay for an Amazon Flex Delivery Driver in the United States is $18.78 an hour. While ZipRecruiter is seeing hourly wages as high as $28.37 and as low as $8.41, the majority of Amazon Flex Delivery Driver wages currently range between $15.87 (25th percentile) to $20.43 (75th percentile) across the United ...Amazon Flex trick #4: Keep your costs down. One of the biggest costs for completing Amazon Flex deliveries is GAS. If you drive an average 60 mile route per 4 hour block, this will approximately equate to $9 in fuel costs. The first trick is the make sure you buy cheap gas. 10 cents per gallon may not seem significant but this will save you $1. ...According to the North Carolina Office of the State Controller, 1099 vendors are trade and non-trade entities or individuals that provide goods, services or contract work for a company.Sign in to Amazon.com using the email address and password that is currently associated with your Amazon Flex account. 2. Click or tap Your Account > Login & security.Many Amazon Flex drives enjoy Anytime Shifts because it offers more freedom. You can easily schedule yourself in for any early morning, night, or weekend delivery times. If you do happen to work more than 40 hours in one week, Amazon will pay you an overtime rate. Additionally, you’ll enjoy these benefits.Most Amazon Flex delivery partners earn $18-$25 per hour.* If you join us, you can build your own schedule, seven days a week. You can schedule work ahead or accept same-day offers when you have spare time. _____ You must be 21 or over and have a valid ID to be an Amazon Flex delivery partner. Is amazon flex 1099, [text-1-1], [text-1-1], [text-1-1], [text-1-1], [text-1-1], [text-1-1], [text-1-1], [text-1-1], [text-1-1], [text-1-1], [text-1-1], [text-1-1], [text-1-1], [text-1-1], [text-1-1], [text-1-1], [text-1-1], [text-1-1], [text-1-1], [text-1-1], [text-1-1], [text-1-1], [text-1-1], [text-1-1], [text-1-1], [text-1-1], [text-1-1], [text-1-1], [text-1-1], [text-1-1], [text-1-1], [text-1-1], [text-1-1]